Per aspera ad astra! Almost any person in the world knows that this Latin phrase means “through hardships to the stars”. Truth be told, the most challenging and ambiguous situations define our greatest achievements. INTEA is no exception to the rule. Our main hardship was MiFID project that had to deliver complex material within months. Today we would like to tell you a story of how we found our way to the starts!

3560 hours spent, 22 modules delivered, 9 months of work, 4 parties involved, localization in 3 languages. These facts are hard to believe, yet they describe one of INTEA’s projects – MiFID. Of course, such outstanding results rarely come without numerous issues and a good strategy to overcome them. That's why in this article we share with you the insights of the project, the difficulties we faced on the way, and ideas on how to approach complex e-learning projects like MiFID.

The puzzle of MiFID II

MiFID is the Markets in Financial Instruments Directive that was introduced in 2007 to guide processes in the EU financial markets. The purpose of this document is to provide rules that increase transaction transparency, improve competitiveness, and regulate business and reporting conducts for financial firms. However, with time any regulation becomes outdated and needs a thorough revision. The changes and improvements to MiFID led to the creation of an updated version, MiFID II, and Markets in Financial Instruments Regulation (MiFIR) in 2017.

MiFID II, though having the same purpose of creating a more efficient financial market, specifies very different conditions on reporting, investor transparency, and trading. These advances, invisible to a regular trader, led to significant changes in the ways banks and major financial firms function. According to MiFID II, financial institutions are now obliged to provide more open access data, change the way investor consultation services are conducted, and revise management bodies and client connections.

All these changes put banks in need of educating their existing and future employees on the new way to do business and communicate with clients.

In the Baltics, there are 2 major banks that had to adjust to the new directive as fast as possible: Swedbank and SEB. Both of them turned to INTEA to develop a training on MiFID II regulation for employees of different levels and job functions. The content for the course was provided by Baltic Financial Advisors Association , which is a non-profit organization that provides banks in Latvia, Estonia, and Lithuania with financial advice. This put INTEA into a difficult position to create many learning modules that convey difficult content in an easy way within just a few months. Coming forward, the MiFID project has become a major achievement for INTEA as we had to overcome numerous obstacles to get to the unforeseeably great outcomes!

The rocky road to success

The success didn’t come to INTEA easily. Initially, we saw just many “buts” that could prevent us from delivering a high-quality learning product. More specifically, the complexity of the project presented us with a number of challenges:

1) The major challenge for any e-learning agency is the restricted amount of time for course development. The updated version of MiFID II was announced in 2017 and was supposed to come in power from next January, meaning industry players had less than a year to adjust their operations.

INTEA was able to produce 22 out of 24 modules in 9 months and localize them into 3 different languages, which required an enormous amount of planning and resources.

2) There were 4 parties involved in the project: SEB, Swedbank, BFAA, and INTEA. This created a communication challenge, since each organization had numerous representatives, their own subject matter experts, and key contact people. The situation was further complicated by the fact that these two banks, being the largest in the Baltics, had significantly different values and approaches to internal training.

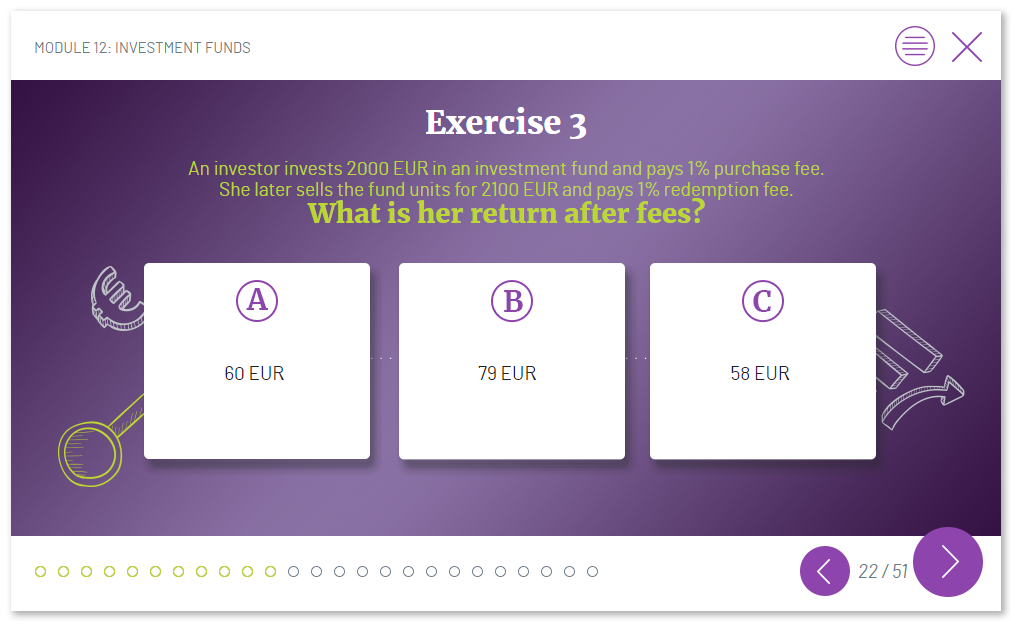

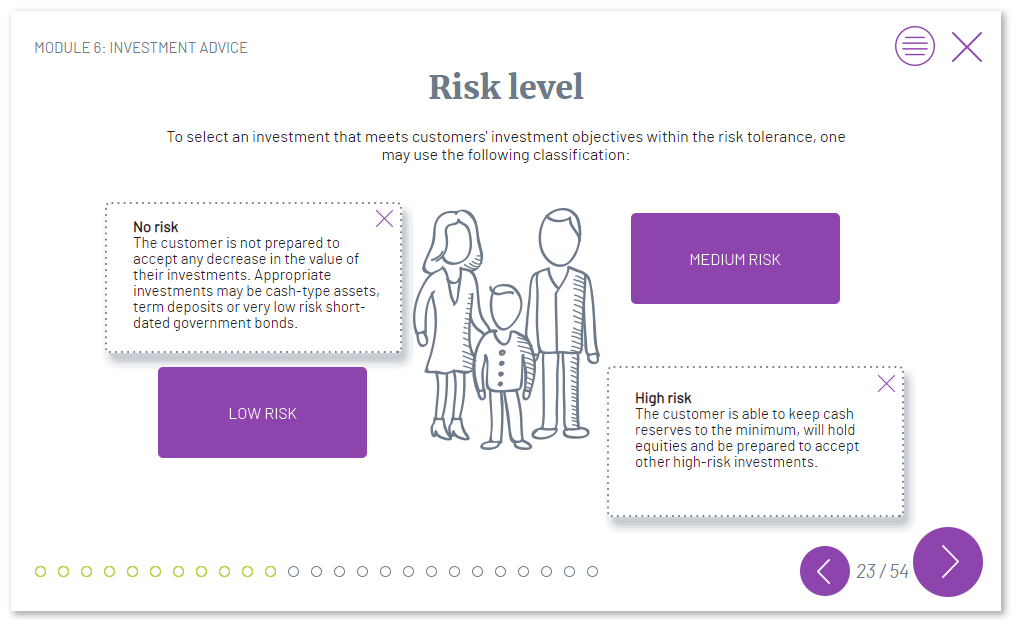

3) The content itself was hard to process and present in a way that would be understandable for the average banking worker.

To create a successful course, it’s essential for e-learning producers, be they script writers or the project manager, to understand the subject at each stage of training production.

At INTEA, we all come from different backgrounds, with only few people who have a degree in Economics and Finance. Such type of content takes long-lasting university courses and years to understand, but the goal for MiFID project was to provide employees with a profound understanding of financial markets within a few weeks, meaning INTEA team had even less time to get acquainted with the main principles of finance.

4) Finally, due to the regulation being relatively new, there was no good source that contained all the information in one place. INTEA team had to combine pieces of data from a variety of books and platforms, accounting for differences in country regulations and requirements provided by our clients.

Steps towards success

In a project like MiFID, the outcome can't fully depend upon the actions of one party. Like in a complex mechanism, all the components involved in the training development had to work promptly and accurately, interact well with one another, and perform the assigned duty in the best way possible to ensure the machine doesn’t fail. In the case of INTEA’s project, there were several secrets that helped us achieve the desirable result.

1) It’s important to come up with a clear idea, a well-thought-out concept, and a feasible prototype at the very beginning of the negotiations. This way you can take control of the project from the start: calculate the resources needed, estimate the time frame and budget, find ways to engage all parties. At INTEA, the clearly communicated idea of the course allowed us to come up with technical and communication guidelines that gave clarity to our specialists and banks on what was needed to be done.

2) The next step is to prepare a thorough working plan and execute it so that there are no delays in the production process. Our project managers decided to complete the project in weekly cycles, seeing it will be more convenient to have the same deadline (which was Friday morning) every week. The result was that INTEA employees always knew the deadline and could plan their time accordingly. Even if there was a delay, it could be fixed during the weekends so that on Monday everyone could start the next module.

3) The key component of success is people. There was enormous work done in the field of people management. The banks, BFAA, and INTEA worked together to make sure every person involved knew the goal of the project, the timeline, and never got lost in the process. Thanks to this collective effort, everyone stayed devoted to complete the MiFID course and rarely missed a deadline.

4) Given the restricted amount of time, the course itself had to be adopted. The main thing was to get rid of all the nice-to-have things and focus on the elements that add pedagogical value. Although there are many ways to draw the attention of the learner that actually benefit the learning process , the training was supposed to deliver clear information without any distractions. Therefore, INTEA specialists decided not to use any elaborate animation or sound, rather focusing on the illustrations and simple design that convey essential points.

5) And last but not least was the cooperation between INTEA and our clients. First of all, every person involved in the process came through the onboarding training prepared by INTEA that explained how e-learning production works and which employee is needed at each stage of the course production. Second, only cloud-based tools, such as Google Docs and online spreadsheets, were used to gather feedback and provide any updates. This way no one got lost in the emails and could instantly track the changes implemented by any party. Third, weekly catch-ups with the core team of experts were established. Every Friday there was a call with the bank specialists to discuss the finished module. It was done to raise any questions or concerns, check the accuracy of information, and resolve any content-related issues before Monday when the team had to move on to the next module. Finally, although SEB and Swedbank are the two competing banks in the Baltics, their experts’ professionalism made it possible to put all the differences aside and solve any disagreements on the spot.

Among the stars

MiFID project required INTEA team and our clients’ experts to get used to a completely different working style. It wasn’t easy for anyone, but in the end, we managed to deliver 22 modules in a record 9 months. For an e-learning course of such a great volume and this level of quality, this was unthinkable. However, we consider the learner’s feedback a much greater achievement.

Both banks gave people the choice of preparing for the test on the new regulation either by reading a book or taking an e-learning course. The vast majority of workers decided to try e-learning as it was easier and faster.

Surprisingly, almost 100% of those who took our course passed the test on their first try! We definitely expected the training to succeed, but no one could predict the rate would be so big.

Employees rated highly the ability of the training to explain “bulky” and “heavy” information on financial markets in a simple and rather straightforward way. This meant a lot for INTEA team who had to become experts in the industry of finance themselves within a few weeks. Moreover, many mentioned the ease of navigation and illustrative examples as additional things that they enjoyed most about the course.

The good news kept coming! What we are most proud of is the fact that training was adopted by other banks and financial institutions in the Baltic region soon after its release. The largest players in the banking industry in the Baltics are now using this course to explain MiFID II to their employees as they consider it the best way to get acquainted with the complex requirements on financial markets.